Increasing annuity formula

Only IRS approved RMD tax deferral investment until age 85. There are few actual perpetuities in existence.

Annuity Formula Annuity Formula Annuity Economics Lessons

The present value formula is the core formula for the time value of money.

. FREE Quotes on all QLAC insurance companies. Save thousands on your IRA RMD taxes along with guaranteed lifetime income. A perpetuity is an annuity that has no end or a stream of cash payments that continues forever.

The formula for determining the present value of an annuity is PV dollar amount of an individual annuity payment multiplied by P PMT 1 1 1rn r where. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply. The regular annuity obtained after increasing your service by the time between your retirement and your 60th birthday.

One of the most powerful things about this spreadsheet is the ability to choose different debt reduction strategies including the popular debt snowball paying the lowest balance first or the debt avalanche paying the highest-interest first. If you have the first element you can easily calculate the rest iteratively. On the other hand a downtrend market indicates that asset prices are moving in a downward direction ie.

It will give you more room to play and make use of an increasing interest rate. Marginal cost formula in Excel With excel template The following table gives a snapshot of how marginal cost varies with the change in quantity produced. A pension may be a defined benefit plan where a fixed sum is paid regularly to a person or a defined contribution plan.

A portion of each payment is for interest while the remaining amount is applied towards the. In an annuity the market rates get locked and if the rate increase in the future you will lose out those opportunities. But this can be mitigated up to an extent by not entering into long term annuity and doing gradual annuity.

Keep increasing over a certain period of time. The above formula is used when direct inputs like units and sell value per unit is available however when product or service cannot be calculated in that direct way then another way to calculate sales revenue is to add up the cost and find the revenue through the method called absorption. Each of the other formulae is derived from this formula.

The future value formula could be reversed to determine how much something in the future is worth today. Learn how you can save 100s or even 1000s of dollars. A regular formula member can retire between the ages of 55-59 with 25-29 years of service with a pension reduced 12 of 1 for each month under age 60.

For example the United Kingdom UK government issued them in the past. Latest news on economy inflation micro economy macro economy government policy government spending fiscal deficit trade trade agreement tax policy indian. The last formula can be used in the service industry to calculate the sales revenue of the firm.

The GDP formula of factors like investment consumption public expenditure by government and net exports Investment. Powerball jackpot winners will receive 30 payments over 29 years each payment increasing by 5 - if they choose the annuity options. A pension ˈ p ɛ n ʃ ə n from Latin pensiō payment is a fund into which a sum of money is added during an employees employment years and from which payments are drawn to support the persons retirement from work in the form of periodic payments.

First 5 years of service. Sold by financial services companies annuities can help reinforce your plan for retirement. Compare Instant FREE QLAC Quotes.

15 percent of your high-3 average salary for each year. An annuity is an insurance contract that exchanges present contributions for future income payments. Real estate and preferred stock are among some types of investments that affect the results of a.

Must contain at least 4 different symbols. Yearly Half- Yearly Quarterly Monthly. So if we use relative change formula revenue has increased by 10 100 10 but cost has been increased by 10 80 125.

So this will impact the profit of the company and they can dig deep and understand why the cost is increasing and can take corrective action to curb the cost. The investment includes everything including the construction of housing societies offices factories and an increase in the inventories of goods. Calculate the present value of an annuity due ordinary annuity growing annuities and annuities in perpetuity with optional compounding and payment frequency.

An amortization schedule is a table detailing each periodic payment on an amortizing loan typically a mortgage as generated by an amortization calculator. Unused Sick Leave Unused and unpaid sick leave can be used to meet service eligibility requirements and. ASCII characters only characters found on a standard US keyboard.

Second 5 years of service. Just choose the strategy from a dropdown box after you. For example annuity payments scheduled to payout in the next five years are worth more than an annuity that pays out in the next 25 years.

To calculate the first payout you can solve the formula used to calculate the sum of the numbers in a geometric progression. The annuity will be payable in arrears at the end of chosen annuity payment frequency from the date of purchase of the plan. Annuity formulas and derivations for present value based on PV PMTi 1-11in1iT including continuous compounding.

Years of Service What You Receive. For example the annuity formula is the sum of a series of present value calculations. You can use the following Calculator.

QLAC Qualifying Longevity Annuity Contract allow to shield 145000 in IRA dollar from RMDs. Through an annuity deduction just like one you would use to contribute to a bank or credit union account you can transfer funds to your TreasuryDirect account and purchase savings bonds. Annuity instalments shall be as specified below.

The present value PV formula has four variables each of which can be solved for by numerical methods. Even if the full CSRS COLA rate of 59 or FERS COLA rate of 49 a prorated COLA would result in the annuity rate not increasing 100 is still added. These were known as consols and were all finally redeemed in 2015.

Trend Analysis Formula Calculator. Investment means additions to the physical stock. Dividend Discount Model DDM Formula Variations Examples and Shortcomings The dividend discount model DDM is a system for evaluating a stock by using predicted dividends and discounting them.

6 to 30 characters long. Get Max RMD Income Guaranteed. A market is said to be on the uptrend if the asset prices move in an upward direction ie.

The annuity payout frequencies available are. Get 247 customer support help when you place a homework help service order with us. In other words assuming the same investment assumptions 1050 has the present value of.

Amortization refers to the process of paying off a debt often from a loan or mortgage over time through regular payments. Further the graph for marginal cost reverses trend after a certain when which indicates that after a certain level of production the cost of production starts to increase after an initial.

Growing Annuity Payment Formula Fv Double Entry Bookkeeping

Present Value Of A Growing Annuity Formula Double Entry Bookkeeping

Present Value Of A Growing Annuity Formula With Calculator

Present Value Of A Growing Perpetuity And A Growing Annuity Youtube

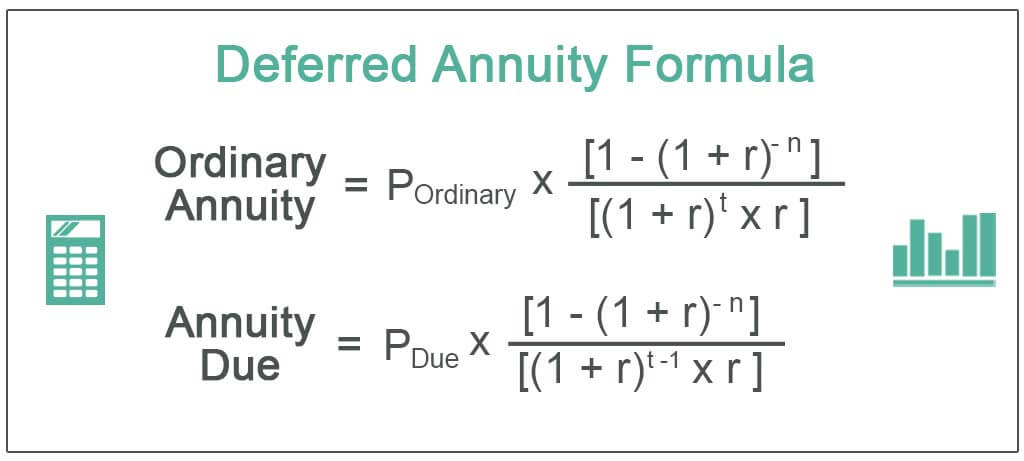

Deferred Annuity Formula How To Calculate Pv Of Deferred Annuity

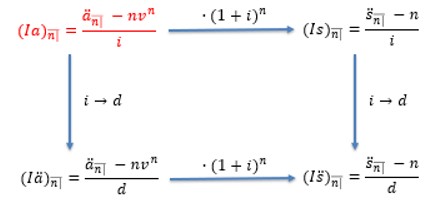

Annuities Cash Flows With Non Contingent Payments Cfa Frm And Actuarial Exams Study Notes

Future Value Of A Growing Annuity Formula Double Entry Bookkeeping

Present Value Of A Growing Annuity Formula With Calculator

Growing Annuity Equation With Description Tote Bag For Sale By Moneyneedly Redbubble

Present Value Of A Growing Annuity Example 1 Youtube

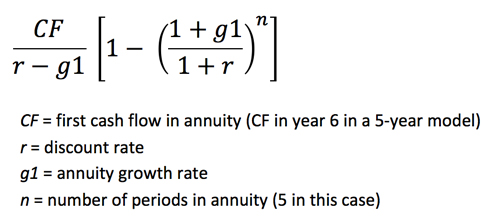

How To Model Multi Stage Terminal Values The Marquee Group

Growing Annuity Formula With Calculator Nerd Counter

Arithmetically Increasing Annuities Soa Exam Fm Financial Mathematics Module 2 Section 6 P1 Youtube

Growing Annuity Equation With Description Poster For Sale By Moneyneedly Redbubble

Increasing Annuities Youtube

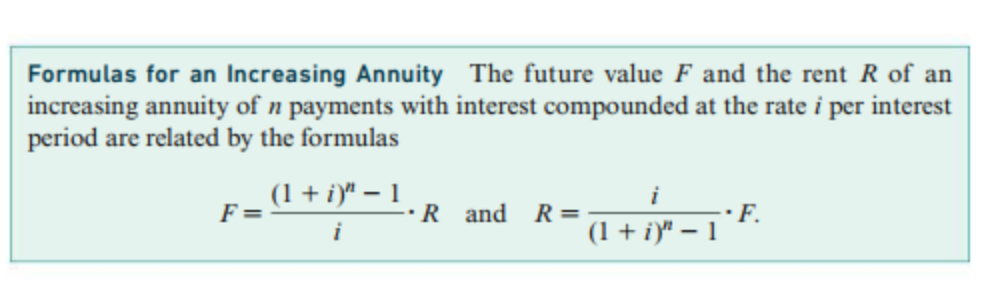

Solved Formulas For An Increasing Annuity The Future Value F Chegg Com

Present Value Of A Growing Annuity Due Formula Double Entry Bookkeeping